Do you hope to find 'equity valuation thesis'? You will find all the information on this section.

Table of contents

- Equity valuation thesis in 2021

- Tesla valuation report pdf

- Private equity valuations

- Equity valuation model

- Equity valuation research papers

- Equity valuation questions and answers pdf

- Equity valuation theory

- Equity valuation notes

Equity valuation thesis in 2021

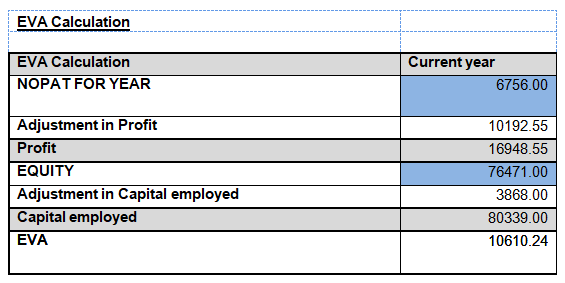

This picture demonstrates equity valuation thesis.

This picture demonstrates equity valuation thesis.

Tesla valuation report pdf

This picture illustrates Tesla valuation report pdf.

This picture illustrates Tesla valuation report pdf.

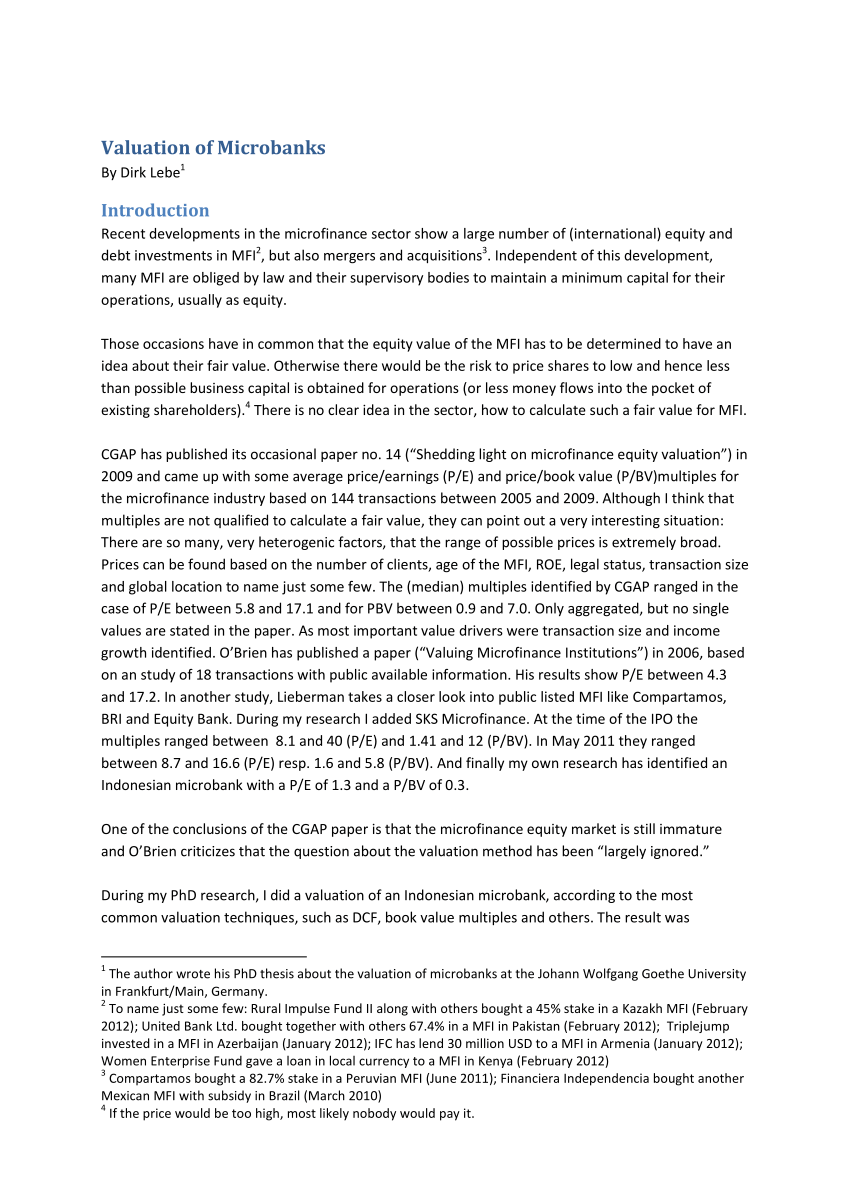

Private equity valuations

This picture demonstrates Private equity valuations.

This picture demonstrates Private equity valuations.

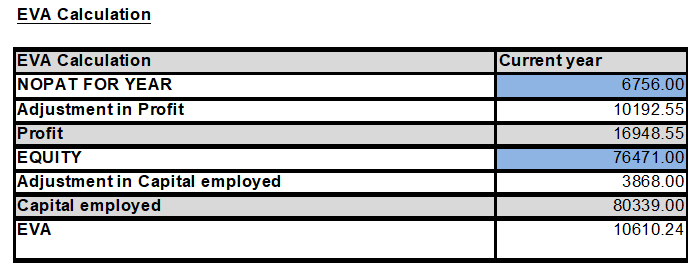

Equity valuation model

This picture representes Equity valuation model.

This picture representes Equity valuation model.

Equity valuation research papers

This picture demonstrates Equity valuation research papers.

This picture demonstrates Equity valuation research papers.

Equity valuation questions and answers pdf

This image demonstrates Equity valuation questions and answers pdf.

This image demonstrates Equity valuation questions and answers pdf.

Equity valuation theory

This picture representes Equity valuation theory.

This picture representes Equity valuation theory.

Equity valuation notes

This image representes Equity valuation notes.

This image representes Equity valuation notes.

How is the valuation of a company determined?

The valuation methodology will be based on the utilization of multiples from the sector and similar companies and the discounted cash flow, all to determine the final value of the share of the company and make the decision of either buy, hold or sell. 2. Introduction

What does it mean to write an investment thesis?

Investment thesis is part of a stock pitch which is used in interview of Hedge Fund, Equity Research, Equity Sales. Writing a good Investment Thesis requires a careful process of researching, developing and asking for feedback from analysts or fund managers.

Which is the best method for valuing a company?

There are basically two types of methods in valuing a company: relative valuation and intrinsic valuation approach. They are commonly used in Private Equity, Equity Research, Merger and Acquisition (M&A). The relative valuation approach includes company comparables and precedent transactions.

What should be included in a valuation thesis?

1. Abstract In this thesis, the main reasons and motivations for enabling a valuation process are disclosed, as well as it is the definition and specification of the different valuation methods, commonly used for similar companies and sectors, such as the Discounted Cash Flow, the Multiples and the Price to Earnings Ratio methods.

Last Update: Oct 2021